More About Mileagewise - Reconstructing Mileage Logs

More About Mileagewise - Reconstructing Mileage Logs

Blog Article

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Buy

Table of ContentsMileagewise - Reconstructing Mileage Logs for BeginnersA Biased View of Mileagewise - Reconstructing Mileage Logs5 Easy Facts About Mileagewise - Reconstructing Mileage Logs ShownThe Ultimate Guide To Mileagewise - Reconstructing Mileage LogsAll about Mileagewise - Reconstructing Mileage LogsSome Known Questions About Mileagewise - Reconstructing Mileage Logs.Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

Timeero's Fastest Range function recommends the shortest driving route to your staff members' destination. This function enhances performance and adds to set you back savings, making it a vital asset for organizations with a mobile workforce. Timeero's Suggested Path function further boosts liability and performance. Workers can compare the suggested route with the real route taken.Such a technique to reporting and conformity streamlines the often complicated job of handling mileage expenses. There are many benefits connected with making use of Timeero to monitor mileage. Allow's take an appearance at some of the app's most significant features. With a trusted gas mileage monitoring tool, like Timeero there is no demand to fret about unintentionally omitting a date or piece of information on timesheets when tax time comes.

Mileagewise - Reconstructing Mileage Logs Things To Know Before You Get This

These added confirmation procedures will keep the IRS from having a factor to object your gas mileage documents. With accurate gas mileage tracking modern technology, your workers do not have to make rough gas mileage price quotes or even fret about mileage expense tracking.

For instance, if an employee drove 20,000 miles and 10,000 miles are business-related, you can cross out 50% of all automobile expenses. You will certainly need to proceed tracking mileage for work even if you're making use of the real expenditure method. Keeping mileage records is the only way to separate company and personal miles and provide the evidence to the IRS

Many gas mileage trackers let you log your trips by hand while computing the range and compensation quantities for you. Lots of additionally included real-time journey tracking - you need to start the application at the beginning of your journey and quit it when you reach your last location. These apps log your beginning and end addresses, and time stamps, together with the overall range and repayment amount.

10 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

Among the inquiries that The IRS states that lorry costs can be considered as an "regular and essential" expense during operating. This includes costs such as gas, upkeep, insurance policy, and the automobile's depreciation. However, for these prices to be considered insurance deductible, the car should be utilized for business functions.

The Best Guide To Mileagewise - Reconstructing Mileage Logs

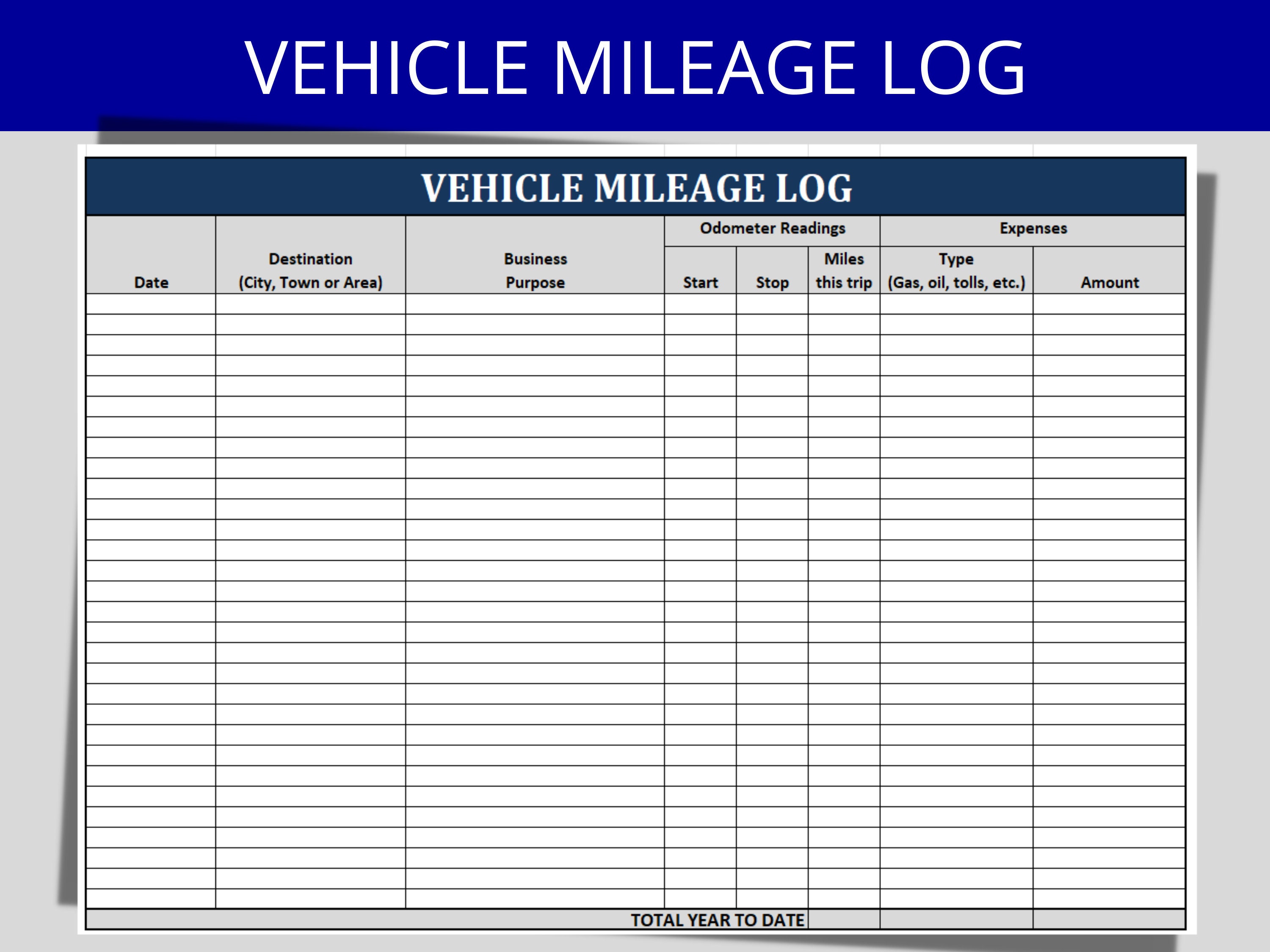

In in between, diligently track all your service journeys noting down the starting and ending analyses. For each trip, record the location and service function.

This includes the total service mileage and total mileage buildup for the year (business + personal), journey's day, destination, and function. It's important to tape-record tasks promptly and preserve a synchronic driving log outlining day, miles driven, and company objective. Below's how you can improve record-keeping for audit purposes: Beginning with making sure a careful mileage log for all business-related travel.

Getting My Mileagewise - Reconstructing Mileage Logs To Work

The actual expenditures method is a different to the common gas mileage rate method. As opposed to determining your deduction based on an established price per mile, the actual expenditures approach allows you to subtract the actual prices associated with utilizing your lorry for company objectives - best mileage tracker app. These prices include fuel, maintenance, repair services, insurance policy, depreciation, and various other associated expenses

Those with significant vehicle-related expenses or special conditions might benefit from the real expenses technique. Inevitably, your selected approach should line up with your particular economic objectives and tax obligation circumstance.

Mileagewise - Reconstructing Mileage Logs for Beginners

(https://www.easel.ly/browserEasel/14536355)Whenever you use your automobile for business journeys, videotape the miles took a trip. At the end of the year, once more write the odometer reading. Determine your see this here total service miles by using your begin and end odometer analyses, and your taped company miles. Precisely tracking your exact mileage for company trips help in confirming your tax obligation reduction, particularly if you select the Standard Gas mileage approach.

Keeping track of your gas mileage by hand can call for persistance, however remember, it can conserve you money on your tax obligations. Record the complete mileage driven.

Indicators on Mileagewise - Reconstructing Mileage Logs You Need To Know

And now nearly everyone uses GPS to get around. That indicates virtually everybody can be tracked as they go concerning their organization.

Report this page